While it is not too late to counter China’s mineral dominance, the window for being able to do so is rapidly closing.

A frequent question arises at public events about national security threats, no doubt reflecting the searing consequences of the US invasion of Iraq: Do we know enough to act? Put another way, is our understanding of a threat sufficiently mature to warrant action and to justify allocating scarce resources toward it over other competing concerns?

The Iraq example notwithstanding, having both spent years working in the Pentagon, we would argue that the greater danger in most instances lies not in acting on insufficient knowledge, but in failing to act despite ample warnings. Modern history illustrates that the recurring sources of failure in the national security realm are less a result of misperception than about procrastination — a collective tendency to postpone hard choices until circumstances force them upon us. Few contemporary examples illustrate this dynamic more vividly than the long-recognized vulnerability of the United States and its allies to China’s dominance in the mining and processing of critical minerals and rare earth elements (REEs).

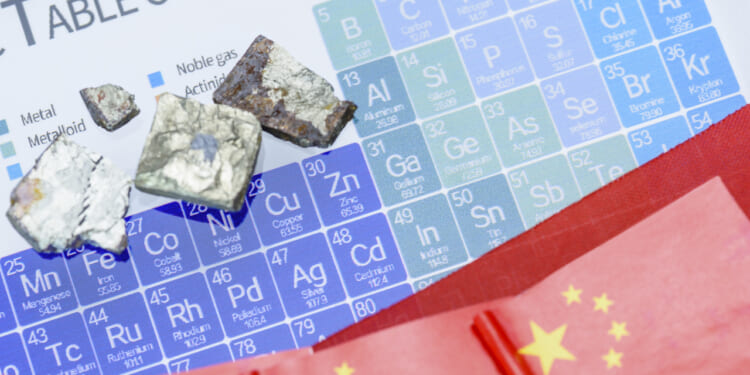

For nearly two decades, analysts, industry leaders, and government officials have understood that Beijing’s near monopoly over the mining and processing of these materials poses a strategic risk. Critical minerals underpin nearly every advanced technology central to modern life, from smartphones and electric vehicles to wind turbines and F-35 fighter jets. China’s grip on these materials is not a product of uniquely beneficial geology; it is an outcome of a deliberate industrial policy, sustained state subsidies, and China’s laissez-faire approach to the environment, which combined to drive competitors out of the global market systematically.

By 2010, China controlled 99 percent of all global REE production, and it began experimenting with using its market position as a source of geopolitical leverage. Following a maritime dispute with Japan, Beijing abruptly halted rare earth exports to its regional rival. The message was unmistakable: access to essential materials could be weaponized in the service of political goals. The embargo sent shockwaves through Tokyo and beyond. Prices for key minerals skyrocketed, and Japanese manufacturers scrambled to diversify their supply chains, develop recycling programs, and explore substitution technologies. Within a few years, Japan had reduced its dependence on Chinese REEs significantly, but only through an urgent, whole-of-nation effort involving government investment, corporate innovation, and diplomatic engagement with alternative suppliers like Australia and Vietnam. Even still, Japan imports over half of its REEs from China to this day.

The United States observed this episode — and did virtually nothing. Despite considerable evidence that China’s actions toward Japan were a test case, Washington failed to mount a coordinated response. Successive administrations acknowledged the risk but treated it as a long-term economic concern rather than a near-term strategic one. The United States initiated a few small-scale investments in domestic mining projects and conducted limited research on material substitution, but the core vulnerability remained unaddressed: the lack of processing and refining capacity outside China. US firms tried to argue that this challenge required a more permissive regulatory environment for mining, but that could only ever be a partial solution, as even raw materials mined in the United States still need to be sent to China for separation and purification, handing Beijing leverage over nearly all of the value chain.

The consequences of decades of complacency are stark. China has now tightened its export controls on rare earths as well as graphite anodes and key battery materials, signaling its intent to use economic dependence as an instrument of statecraft. The United States and its allies have now found themselves scrambling to respond once again, introducing export restrictions of their own, announcing new funding for mining projects, and rushing to breathe life into fledgling critical minerals alliances. These measures, while directionally correct, have so far been reactive, fragmented, and largely symbolic — more of a patchwork of policy gestures than a coherent strategy. Without addressing the processing bottlenecks that underpin China’s dominance, the West will remain perpetually on the defensive.

What might Beijing seek in exchange for restoring the flow of rare earth exports? Concessions on Taiwan or the South China Sea? Removal of US restrictions on technology exports? China may also consider permitting mineral exports selectively in an attempt to drive a wedge between the United States and its allies. Regardless of China’s tactics, by holding critical supply chains hostage, Beijing gains not only economic leverage but also psychological influence. Other countries, as well as major corporations, will increasingly hesitate to oppose China’s demands out of concern for the potential economic consequences.

Avoiding that scenario will demand more than empty rhetoric about “de-risking.” It will require sustained investment at scale and substantive coordination with allies and partners. Three steps stand out as essential. First, the United States should establish and expand strategic stockpiles of critical minerals, much as it maintains a strategic petroleum reserve, to buffer against sudden supply disruptions. Second, Washington should pursue “friendshoring” in earnest. The Trump Administration must put aside its petty frustrations with the long-running allies of the United States and deepen its alignment with Australia, Canada, Japan, the Nordic countries, and others to develop a coherent strategy for building an integrated, resilient network of mining, processing, and mineral recycling facilities. Third, a domestic processing capacity must be developed at scale, even at a high near-term cost. The Trump Administration’s recent decision to cancel $700 million in Department of Energy grants for battery chemical compounds, mineral recycling, and synthetic graphite production was a step backward in this regard.

The White House and Congress need to understand that this is not a slow-moving economic adjustment; it’s a national security imperative that requires robust investment to maintain our strategic autonomy and deter China from leveraging the economic position it has built over decades to coercive effect.

Even as it pursues a more robust de-risking strategy, the United States needs to acknowledge that a near-term decoupling from China in this space is unrealistic. Japan’s experience is instructive. To that end, it would behoove US leaders to consider how to manage escalation with China over trade. The two countries should engage in something akin to arms control over export restrictions, bounding the extent to which such policies are employed. This would avoid an economic crash landing, where forced decoupling leads to catastrophic economic outcomes for both countries.

In September 1940, as Franklin Roosevelt considered US support for the United Kingdom as that country withstood the Blitz, General Douglas MacArthur remarked that “the whole history of failure in war can almost be summed up in two words: too late.” The same may be said of economic security. For years, the West has watched China methodically build an advantage that now threatens to become a permanent source of leverage. Just as in 1940, it is perhaps not yet too late to respond — but it’s getting close. The challenge is not that we lack knowledge of the threat. It is that we have known too much for too long and done too little.

About the Authors: Greg Pollock and Joshua Busby

Greg Pollock is an adjunct professor at Georgetown University’s School of Foreign Service. He served in a series of leadership positions in the Office of the US Secretary of Defense from 2010-2025, most recently as the acting Deputy Assistant Secretary of Defense for the Arctic and Global Resilience Policy.

Joshua Busby is a professor of public affairs at the University of Texas at Austin. From 2021 to 2023, he served as a senior advisor for climate at the U.S. Department of Defense. His first book, “Moral Movements and Foreign Policy,” was published by Cambridge University Press in 2010. His second book, “AIDS Drugs for All: Social Movements and Market Transformations,” with co-author Ethan Kapstein, was published by Cambridge University Press in 2013. His third book ‘States and Nature: The Effects of Climate Change on Security‘ was published in 2022. He received his Ph.D. in political science in 2004 from Georgetown University.

Image: Shutterstock/William Potter