New York State will soon have an opportunity to increase the number of low-income students who can obtain private scholarships, without cutting its public schools budget. The only thing that could stop it are the teachers’ unions, other opponents of school choice—and Governor Kathy Hochul choosing to listen to them over New York parents.

The recently enacted One Big Beautiful Bill Act includes a federal tax credit for taxpayers who donate to “scholarship granting organizations” (SGOs). Those giving up to $1,700 to an SGO will receive a dollar-for-dollar reduction of their federal tax bill. The program has no expiration date or upper limit on donations. Students will be eligible for the scholarships if they come from families with incomes below 300 percent of the area median gross income. In New York, that means between $494,700 in Suffolk County and $231,600 in Cattaraugus County.

Finally, a reason to check your email.

Sign up for our free newsletter today.

But there’s a catch—each state must opt in to receive these funds from the federal government. The law requires “Governors or other entities/individuals designated by state law” to submit a list of SGOs that taxpayers can support. Hochul’s signature is therefore the only thing that stands in the way of helping tens of thousands of New York students starting next year.

But while it may sound absurd to refuse free money, school-choice opponents don’t want more competition from private and religious schools. Randi Weingarten, president of the American Federation of Teachers, criticized the program as a “permanent school voucher scheme into the tax code that would redirect billions of dollars each year to private schools”; David Goldberg, president of the California Teachers Association, called the program “a distraction.” Such pressure is probably one reason why Oregon and New Mexico have said that they will deny this opportunity for their neediest students.

Breaking with the unions would nonetheless be politically savvy. New Yorkers favor choice: 63 percent of adults and 74 percent of school parents said they were supportive of voucher programs, according to an EdChoice survey. Parents increasingly embrace alternatives to public schools. Between 2014 and 2024, enrollment in New York City Department of Education schools declined by 19 percent.

Black and Hispanic voters, who often bear the consequences of low-performing public schools, overwhelmingly favor choice. A nationwide survey from Democratic pollster Beck Research last year showed that 74 percent of African Americans and 71 percent of Latinos support school choice. Ignoring this trend may push these voters toward Republican candidates, contributing to the political shift in New York that began in the last presidential election.

If Governor Hochul decides against including New York’s low-income students in the OBBBA program, New Yorkers will still be free to donate to SGOs for tax relief—but the dollars will support students in other states. Many New Yorkers will likely forego donating to an SGO altogether. That will keep New York’s already enormous tax burden high: in 2023, residents paid $89 billion more in federal taxes than they got in benefits.

If Hochul opts in to the SGO tax credit, it would go a long way toward transforming her education legacy from that of a wasteful spender to a leader who prioritizes New York’s low-income students. Since taking office in August 2021, Hochul has raised the New York School Aid budget by more than $6 billion. According to the Citizens Budget Commission, New York school districts now spend an average of $36,293 per student—a 21 percent increase since the 2020–21 school year and 91 percent above the national average.

But New York’s students have hardly benefited from this spending spree. State Comptroller Thomas DiNapoli highlighted New York’s declines in student performance on the National Assessment of Educational Progress (NAEP) in 2022. Those figures haven’t substantially improved in 2024. Moreover, New York stands out for its high spending relative to such mediocre learning outcomes.

Opting in to SGO could change this unfortunate trajectory. And it could be an opening for a much-needed school choice program for New York State, where for many families choice remains a distant dream.

Governor Hochul should resist pressure from teachers’ unions and others with vested interests in perpetuating a status quo that fails so many students. If she truly cares about helping low-income students and stemming Democrats’ losses among minority voters, she’ll opt in.

With the stroke of a pen, Hochul can enlist New York in the education revolution happening across the country—and improve the lives of tens of thousands of the state’s neediest kids.

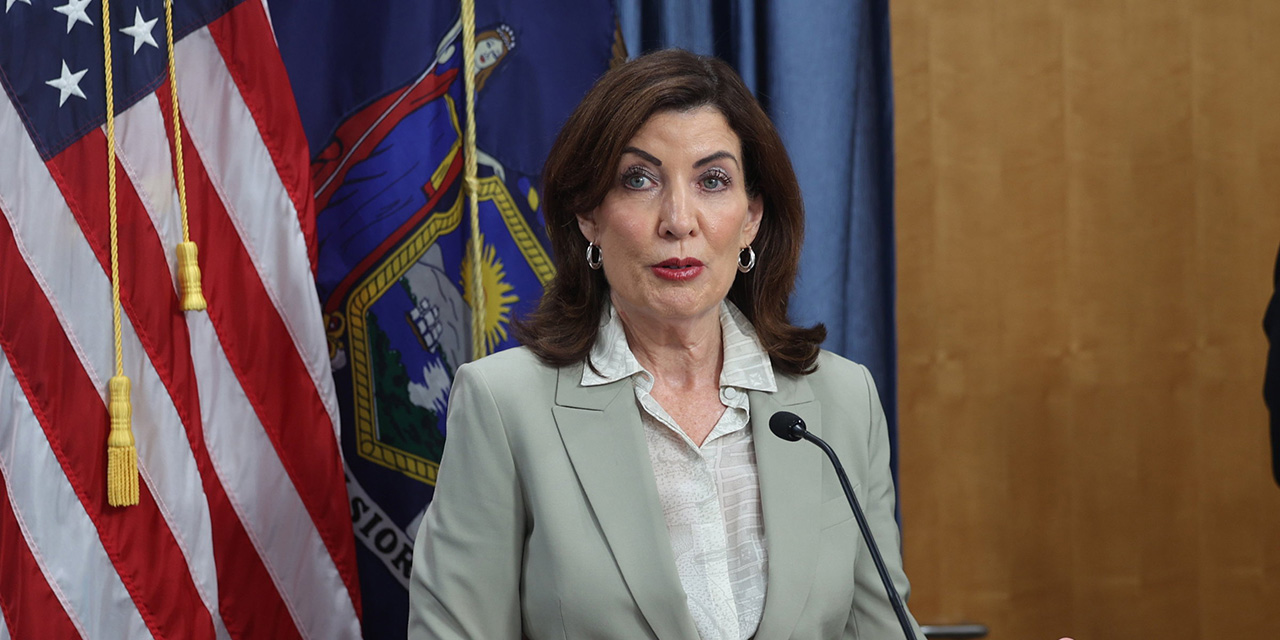

Photo by James Carbone/Newsday RM via Getty Images

City Journal is a publication of the Manhattan Institute for Policy Research (MI), a leading free-market think tank. Are you interested in supporting the magazine? As a 501(c)(3) nonprofit, donations in support of MI and City Journal are fully tax-deductible as provided by law (EIN #13-2912529).

Source link