Since Zohran Mamdani’s unexpectedly decisive win in New York City’s mayoral primary, the media have speculated whether Albany will approve his ambitious tax-raising agenda if he emerges victorious in November. Mamdani believes that tax hikes will enable him to fund major new spending initiatives, such as free bus rides and universal childcare. But the City Council’s adoption of an empty-the-cupboards budget for the fiscal year beginning July 1, 2025, may present the new mayor, whoever he is, with a choice: budget cuts with tax increases, or even greater cuts without them.

The new $116 billion city budget is supposedly balanced for the fiscal year ending June 30, 2026. But the city projects large gaps between revenues and expenditures in future years: a $5 billion shortfall in FY2027, rising to $6 billion in FY2028 and FY2029. To make matters worse, the Citizens Budget Commission (CBC), a nonpartisan watchdog group, projects that the FY2026 budget is $3 billion short of planned spending, and that out-year gaps are more like $8 billion–10 billion.

Finally, a reason to check your email.

Sign up for our free newsletter today.

While the city’s projected out-year budget gaps often look daunting, Gotham estimates revenues conservatively, as a growing economy usually raises tax collections sufficiently to keep the budget balanced. But that strategy doesn’t work in economic downturns.

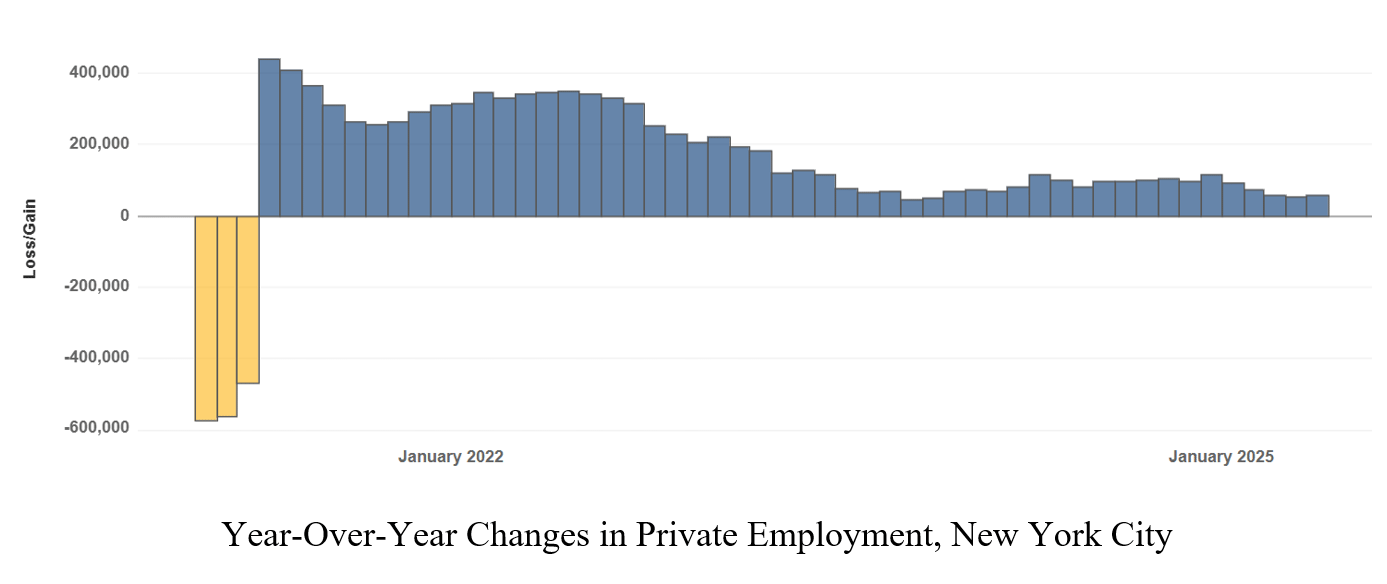

New York City’s economy is slowing down. Year-on-year private employment gains, estimated at 57,100 in May 2025, have declined sharply. Almost all net year-over-year private employment gains are the result of growth in the Social Assistance category, which spiked by 50,500 jobs in April 2025. That, in turn, seems to be a product of Medicaid-funded homecare workers being reclassified as a result of the city’s transition to a single fiscal intermediary.

But New York has long been disproportionately dependent on federally funded home care for employment growth among workers with lower education levels. That situation persists, with home care currently offsetting job losses in the construction, retail trade, and tourism-dependent hotel and restaurant sectors. The key office-based sectors that drive tax collections—finance and professional and business services—have also shown negative year-over-year growth in recent months, a distressing signal.

The national economic outlook is uncertain, to say the least. The immigration crackdown and import tariffs are expected to shave points off U.S. gross domestic product growth. Those changes are likely to be felt in New York City, the nation’s financial and business-services hub. Federal budget cuts in health care, social services, and higher education will also be felt in Gotham’s tax collections. Federal aid cuts to the states could indirectly affect the city, as Albany reduces local aid to fill other spending gaps.

All this was well understood when Mayor Eric Adams and City Council Speaker Adrienne Adams negotiated their FY2026 budget agreement. In a June 2025 report, state comptroller Thomas DiNapoli wrote:

With substantial shifts in the federal funding environment—which could lead the State to make choices to balance its budget that pressure local government finances—preparation and transparency remain paramount to navigate the future. . . . preparing for fiscal uncertainty, including greater contingencies or larger reserves, would be wise at this time. Codifying plans to bolster reserve levels for a rainy day would be a fiscally prudent step.

And yet, the CBC points out, the adopted budget set aside no funding to offset federal budget cuts and added no money to the Rainy Day Fund. The two Adamses—the mayor running as an independent for reelection and the term-limited Speaker—showed little regard for the plight of the next mayor and city council, who will have to deal with the fallout.

New York City mayors have a long and dreary history of taking office amid financial emergencies. Bill de Blasio, bequeathed years of bountiful surpluses by predecessor Michael Bloomberg, was a true outlier. Bloomberg himself took office in 2002 in the aftermath of the 9/11 attack, and with a national recession looming. He proposed closing budget gaps that were proportionally far higher even than those projected by the CBC today. Most of Bloomberg’s modern predecessors, going back to Fiorello La Guardia in 1934, faced similar predicaments upon taking office.

New York City lately has been so economically successful that younger New Yorkers, including many in Mamdani’s youthful primary electorate, have never experienced municipal austerity. They’ve never seen services get worse and municipal workers laid off. Perhaps the city won’t reach that point. But if it does, Gotham still must balance the budget on an accrual basis, the key reform New York State enacted after the city’s 1975 fiscal crisis.

The next mayor may have to spend his time managing a crisis—not inaugurating a socialist paradise or whatever limited vision for the city Mamdani’s rivals have. Journalists and the public should ask how the candidates intend to deal with that scenario.

Photo: DogoraSun / iStock Editorial / Getty Images Plus

City Journal is a publication of the Manhattan Institute for Policy Research (MI), a leading free-market think tank. Are you interested in supporting the magazine? As a 501(c)(3) nonprofit, donations in support of MI and City Journal are fully tax-deductible as provided by law (EIN #13-2912529).

Source link