Conditional non-FTA authorizations have returned under the second Trump administration as the United States continues to be an exporter of LNG to the rest of the world.

Over the past two decades, the United States has undergone a dramatic shift from being a net importer to becoming the world’s leading exporter of LNG. In January 2005, the United States imported a net fifty-two million cubic feet (Mcf) of LNG. By January 2025, the United States had a net export volume exceeding 413 Mcf. This transformation has been fueled by a more than thirty percent increase in domestic natural gas production in the past decade and a surge in global LNG demand, specifically from Europe and Asia.

The resulting export boom has spurred a wave of infrastructure development, particularly along the Gulf Coast. At the time of this article, the contiguous United States hosts eight fully constructed LNG export terminals: Sabine Pass LNG, Corpus Christi LNG, Freeport LNG, Cameron LNG, Elba Island LNG, Calcasieu Pass LNG, and Cove Point LNG. An additional seven terminals are either under construction or in the commissioning phase: Plaquemines LNG, CP2 LNG, Louisiana LNG, Port Arthur LNG, Rio Grande LNG, Corpus Christi Stage III, and Golden Pass LNG.

For US LNG developers, exporting LNG requires authorization from the Department of Energy (DOE). The type of authorization depends on the destination. LNG exports to countries with which the United States has a free trade agreement (FTA) require an FTA export authorization, while exports to non-FTA countries require a separate non-FTA approval.

The threshold for approval is different for each authorization. By statute, DOE must grant FTA authorizations without delay or modification, as they are presumed to be in the public interest. In contrast, non-FTA applications undergo a more rigorous and discretionary review. Under Section 3(a) of the Natural Gas Act (NGA), the DOE must approve the export unless it determines that doing so would not be consistent with the public interest.

In January 2024, the Biden administration launched the 2024 LNG Export Study (2024 Study) to update the public interest, economic, and environmental analysis that guides decisions on non-FTA LNG export approvals. Intended as a comprehensive review of the DOE’s prior macroeconomic and environmental assessments, the study aimed to reflect recent market developments and policy considerations. While this study was underway, the DOE paused all pending and future non-FTA export authorizations, possibly to ensure that future decisions were grounded in updated data and still aligned with the public interest, avoiding potentially reversible approvals.

This pause remained in effect into President Donald Trump’s second administration. During this period, the DOE revived the use of conditional non-FTA export authorizations. These conditional approvals provide preliminary approval for the final non-FTA, which hinges on the developer meeting the requirements specified in the conditional approval.

The rise of conditional approvals likely served as a stopgap measure to provide regulatory certainty and maintain momentum for LNG projects while the 2024 study was still under review. By reintroducing this mechanism, the DOE gave developers a signal of federal support that supported progress toward a final investment decision (FID) for an LNG terminal.

FID represents a crucial milestone, marking the developer’s formal commitment to invest capital in constructing an LNG terminal. The decision to reach FID is often driven by various considerations, such as regulatory approvals, feed gas supply, offtake agreements, project financing, and engineering, procurement, and construction readiness. Conditional non-FTAs help support the first consideration and serve a public role in demonstrating positive regulatory momentum by reinforcing confidence that the project is on track for final approval even before environmental or construction milestones are reached.

Since the 2024 study was completed in May, the DOE has resumed granting final non-FTA export authorizations. Moving forward, we anticipate the agency will primarily rely on final approvals to support LNG project development. However, it is worth examining how the DOE’s revival of conditional non-FTA authorizations represented a calculated use of regulatory discretion to sustain LNG project momentum during a temporary pause in final export approvals. Without the increased regulatory certainty provided by conditional approvals, a few projects may have faced delays that could have undermined US competitiveness in the global LNG market.

A Brief History of Conditional Non-FTA Approvals

Before 2014, the DOE routinely issued conditional non-FTA authorizations as an intermediate step to final approval. Typically, a conditional authorization was issued before completing a National Environmental Policy Act (NEPA) review. Final authorizations were contingent on meeting the conditions outlined in the conditional approval.

Between May 2011 and August 2014, the DOE issued eight conditional non-FTA authorizations for seven projects, four of which are operational today. However, in August 2014, the DOE changed its policy to issue non-FTA approvals only after completing NEPA reviews. This effectively rendered the conditional step obsolete. At the time, the DOE cited several reasons for the shift:

- Conditional authorizations no longer appeared necessary for FERC or most applicants to devote resources to NEPA review.

- Eliminating conditional approvals prioritized acting on applications that were ready to proceed and prevented unnecessary delays.

- Decisions would be based on more complete information.

- Agency resources would be allocated more efficiently.

Although the DOE discontinued the practice, it explicitly retained the authority to issue conditional approvals in the future. In 2025, the Trump administration revived the practice and issued two conditional authorizations for the Commonwealth LNG and CP2 LNG projects.

Insight Provided by Conditional Non-FTAs

Historically, conditional non-FTA authorizations offered early insight into the likely terms of a future final order. Typically, they included two key elements: the length of the authorization period and the event that triggers the start of the authorization period.

We analyzed the conditional non-FTA approvals issued for the seven LNG projects between May 2011 and August 2014. Our analysis reveals that, while the duration of authorization generally remained unchanged in the final orders, the event triggering the authorization period often slightly shifted. For example, in the conditional approvals for Freeport LNG, Cove Point LNG, and Jordan Cove LNG, the export period began upon the “first export” or “first export or seven years from the conditional approval.” However, in the final orders, DOE adjusted the language to begin after the “first commercial export or seven years from the final order.”

Although this distinction may raise questions about the predictive value of conditional authorizations, they still provide helpful insight into final non-FTA orders, particularly regarding the length of approval and the required conditions.

How Commonwealth LNG and CP2 LNG Compare

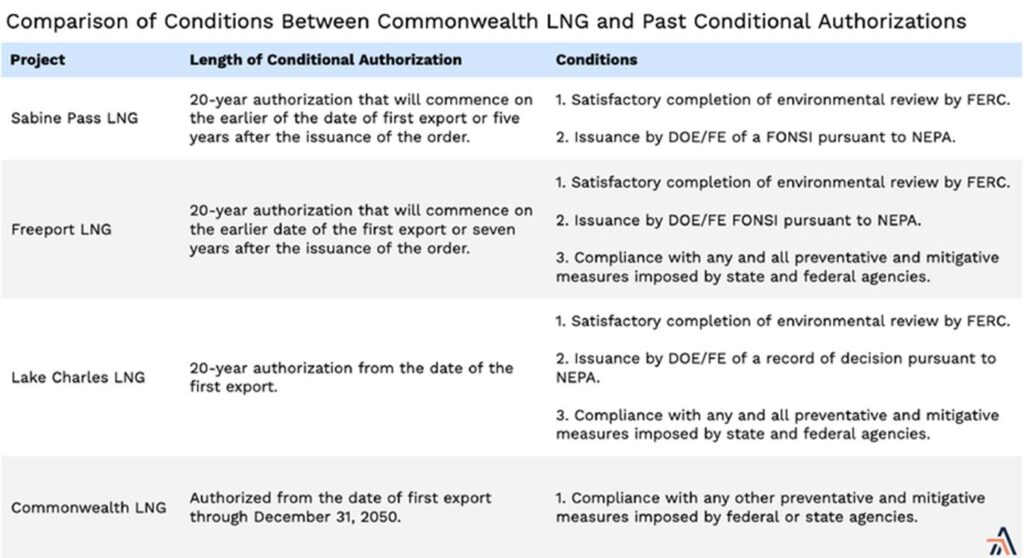

To understand how recent projects compare, we analyzed the recent conditional approvals for Commonwealth LNG and CP2 LNG against the approvals issued between 2011 and 2014. We focused on two factors: the authorization duration and the conditions attached to the approval. Projects with identical terms—Cove Point, Cameron, Jordan Cove, Oregon LNG, and CP2 LNG—were excluded from individual listings.

Table courtesy of Arbo.

As shown in the table above, the authorizations for Commonwealth LNG and CP2 LNG both extend through the end of 2050, which differs from earlier approvals in terms of duration. However, this is consistent with recent non-conditional DOE decisions—such as those for Lake Charles LNG and Calcasieu Pass—which also set expiration dates at the end of 2050.

Conditional Non-FTA Impact on Projects: Risk and FID

The conditional non-FTA approvals issued in 2025 increased regulatory certainty for developers at a time when final authorizations were paused. Unlike earlier conditional approvals, which were typically contingent on the completion of a NEPA review, the 2025 authorizations for Commonwealth LNG and CP2 LNG were not tied to that process. This shift marked a significant departure from past practice and streamlined the regulatory path for developers.

By de-linking the conditional authorization from NEPA review, DOE reduced the procedural hurdles required before a final authorization could be issued, thereby lowering the barrier to final approval and creating a more predictable regulatory path for developers.

Regulatory uncertainty remains a material risk to LNG project viability, even for projects that have secured major federal approvals. In 2024, both Rio Grande LNG and Texas LNG faced the risk of halting construction activities after the D.C. Circuit vacated FERC’s approval for the projects. Conditional approvals help mitigate these risks by providing an early signal that a project is on track for final non-FTA approval. In turn, this supports the developer’s ability to reach FID.

Both the CP2 LNG and Commonwealth LNG demonstrate how conditional approvals can signal progress on a project. For CP2 LNG, developed by Venture Global, the conditional non-FTA approval in March 2025 marked a key milestone. Venture Global CEO Michael Sabel noted during Venture Global’s Q1 2025 earnings call that the authorization, alongside FERC approvals, was essential to progressing toward FID. By May, the project had received its Supplemental Environmental Impact Statement and FERC authorization to begin mobilizing equipment. It is now expected to reach FID by the end of 2025.

Commonwealth LNG shares a similar story. In March 2025, the developer noted that the conditional approval, along with a FERC final order (issued in June 2025), would provide key support for the project to reach FID in Q3 2025.

The Bridge to Final Approval

In addition to supporting forward momentum for Commonwealth LNG and CP2 LNG projects, the conditional approvals also explicitly stated that all issues addressed in the conditional authorization will be reexamined in a final order, as informed by the 2024 study.

The structure and effect of the conditional approvals reflect how they served as a regulatory bridge, providing interim certainty and encouraging forward progress for project developers during a period when the analytical framework underpinning DOE’s analysis for non-FTA approvals was on shaky ground. Rather than delay action until the study’s completion, DOE revived conditional authorizations to signal that the projects would likely align with DOE’s public interest determination once the study was complete.

The findings in the 2024 study suggested that while increased exports would contribute to economic growth and would not have a negative impact on domestic energy prices, they would lead to higher global greenhouse gas emissions. However, since the DOE concluded that LNG exports would still be consistent with the public interest, it provided a basis for the DOE to resume issuing non-FTA export authorizations. Given the study’s conclusions and recent DOE actions, we expect Commonwealth LNG and CP2 LNG to receive final export approvals.

That expectation is further supported by the fact that the DOE has already issued a final non-FTA authorization in May 2025 for Port Arthur LNG (PALNG) Phase II. In its approval, the DOE states that “the 2024 LNG Export Study supports DOE’s finding that PALNG Phase II’s proposed exports will generate net economic benefits to the US economy and will not be inconsistent with the public interest.”

The consideration of the 2024 study in PALNG Phase II’s final approval also signals to other developers that the public interest standard has been reaffirmed under current market and environmental conditions, potentially reducing one aspect of regulatory uncertainty for projects still in the pre-FID stage. It is reasonable to view the PALNG Phase II order not just as an isolated decision but as a clear indicator that the DOE does not view the results of the 2024 study as a barrier to authorizing future LNG exports.

Summary

The DOE’s revival of conditional authorizations during the LNG export authorization pause serves both as a political signal of continued support for LNG and as a tool to provide partial regulatory certainty. For CP2 LNG and Commonwealth LNG, these approvals allowed developers to signal progress during the 2024 study.

Now that the 2024 study is complete, the DOE has resumed issuing final export authorizations. The recent approval of Port Arthur LNG Phase II indicates that CP2 and Commonwealth are likely next in line.

While not a replacement for final approval, conditional authorizations offer a meaningful bridge by supporting developers during a period of regulatory uncertainty.

About the Authors:

Rohan Nimmagadda is an energy analyst at Arbo, where he anticipates and interprets energy regulatory events impacting energy infrastructure, forecasts in-service dates of pipelines and LNG terminals, and supports the production and delivery of customer deliverables. He has interned in the office of Congressman Randy Weber (TX-14) and at Brownstein Hyatt Farber Schreck. He holds a B.S. in Business from the George Washington University.

Dr. Kristoffer Svendsen is the Assistant Dean for the Energy Law Program at George Washington University. Dr. Svendsen has a Bachelor of Laws and Master of Laws from Bond University, Australia, specializing in public and energy law. After Australia, he went on to undertake another Master of Laws in Russian oil and gas law at MGIMO-University and his Ph.D. at the Arctic University of Norway. Before arriving at GW, Dean Svendsen worked as the Assistant Director of the Tulane Center for Energy Law, Associate Professor at the University of Stavanger, an associate member of the Aberdeen University Centre for Energy Law, Of Counsel of a Moscow law firm, a visiting scholar at Duke University Law School, and volunteered for 2014 Sochi Olympics. He also works periodically as an Arbitrator.

Thank you to Arbo’s Director of Permitting Intelligence, Thomas Sharp, for his support in this article.

Portions of this article are based on an original piece written by Rohan Nimmagadda and published by Arbo, a natural gas data analytics company based in Washington, D.C.

Image: Shutterstock/Maksim Safaniuk