How Many Greens Does Your Land Have Anyway?

Welcome back to Friday. This is the Breitbart Business Digest’s weekly wrap, where we run through the news of the week with the wild abandon of a Canadian Prime Minister kowtowing to Chinese communists.

This week, President Trump got lost on his way to single-handedly invade Greenland and wound up in Davos, Switzerland. Once there, he decided he did not want to invade Greenland after all. Turns out that they don’t even have many greens. The Nuuk Golf Club is just nine holes and only playable a few months a year. The Uummannaq course is for something called “ice golf,” which sounds like it might be fun to drink but not so much fun to play.

A television on the floor of the New York Stock Exchange broadcasts President Donald Trump speaking at the World Economic Forum on January 22, 2026. (Michael Nagle/Bloomberg via Getty Images)

Forget TACO. The Reality is PALM

Of course, Trump never intended to invade Greenland but a lot of supposedly intelligent pundits, market analysts, and global political leaders talked themselves into believing he did. We think it’s important to note for the record that they really did think this.

“The big topic was Greenland,” Andrew Ross Sorkin, the CNBC/New York Times guy who is arguably the world’s most influential financial journalist, reported from Switzerland. “For days, there was consternation and hand-wringing about whether the president, President Trump, was going to pursue military action against Greenland, to control Greenland. That was then taken off the table and all those conversations became an almost moot point.”

Anyone paying attention and not blinded by the veil of Trump Derangement Syndrome never expected that Trump was going to invade Greenland. Even the threat of tariffs on European trading partners who pushed back against the U.S. when it came to Greenland were unlikely to be imposed. The president’s declared desire to own Greenland was clearly the opening bid in a negotiation, just as the Liberation Day tariff rates were intended to jump-start trade negotiations.

While the details are still fuzzy, it has been reported that the U.S. may actually get some sovereignty over pieces of Greenland where we have military bases, some rights with respect to Greenland’s rare earth minerals, and a plan to secure shipping lanes in the North Atlantic. It also seems likely that NATO allies will commit more funding to the defense of Greenland and the Arctic. Most importantly, we got our allies to agree to work with us to prevent Russia and China from gaining a foothold in Greenland.

Predictably, when Trump said Wednesday that he had reached the framework of a deal over Greenland’s future, the usual TDS suspects declared this was an example of the TACO phenomenon. That’s an acronym for Trump Always Chickens Out that was coined by people who keep being surprised when the reality of Trump’s policies are not as bad as the worst-case scenarios they fantasized. A better acronym is PALM: Panicans Always Lose Money. Investors who bought into the narrative Sorkin described sold into the panic early in the week, only to miss the relief rally when the fearmongering proved unwarranted.

Secretary of Commerce Howard Lutnick had it right when he said in a Bloomberg interview from the World Economic Forum in Davos: “They overreacted, and there’s proof that they overreacted because now there’s a framework that makes sense.”

Trump’s Shining City on a Hill

Trump did not travel to Davos just to call off the imaginary invasion of Greenland. He also delivered a few important messages to our friends in Europe. He advised Europe to cool it with the mass immigration that is tearing the continent apart economically and politically. He urged our allies to spend more on their own defense instead of free-riding on the budget deficit of the United States. He pointed to his own deregulation efforts as an example of how to reinvigorate their moribund economies. And he told them to avoid the trap of relying on Russia for energy while crippling themselves with climate fearmongering policies against local fossil fuel production.

President Donald Trump delivers remarks at the World Economic Forum in Davos, Switzerland, January 21, 2026. (Official White House Photo by Daniel Torok)

This was a Reagan-esque moment for Trump, echoing the Reagan administration’s theory of “convergence.” That was the idea that the best thing the U.S. could do for our allies was to set an example—be the “shining city on a hill”—of proper governance and economic stewardship.

This was the purpose of touting his economic agenda’s early results and outlining ambitious plans ahead. He highlighted that his tariff and trade policies have driven new factory construction and trade deals favorable to the United States, while cutting the monthly trade deficit significantly without triggering the inflation that critics had predicted. Trump pointed to the summer’s major tax legislation, which delivered cuts for middle- and upper-income households, eliminated taxes on tips, and made 100 percent bonus depreciation permanent to incentivize companies to shift production to America. On energy, he announced the administration is “going heavy into nuclear” while criticizing wind power and China’s dominance in windmill manufacturing.

Trump outlined several populist economic proposals aimed at helping ordinary Americans. He called on Congress to limit large institutional investors buying single-family homes, declaring that “homes are built for people, not for corporations” and vowing that “America will not become a nation of renters.”

He proposed capping credit card interest rates at 10 percent for one year to provide relief to borrowers. Trump noted that gasoline prices have already fallen to $1.99 or below in numerous states since his return to office. He also promised that his healthcare policies would reduce U.S. drug costs by 90 percent or more through “most favored nation” pricing that would allow America to purchase pharmaceuticals at the lower rates paid by other developed countries. Additionally, Trump reiterated his push to limit defense contractors’ stock buybacks, requiring them instead to reinvest those funds in manufacturing plants to accelerate military equipment production.

Innovation and Investment Beats Immigration and Cheap Labor

One underappreciated aspect of last year’s tax law is that it restored 100 percent bonus depreciation, allowing businesses to immediately expense capital investments rather than depreciating them over years or decades.

This matters more than it sounds. Under traditional depreciation rules, the tax code systematically favored cheap labor over capital investment and innovation. Spend $100,000 on wages, get a $100,000 deduction this year. Spend $1 million on equipment, spread that deduction across five, seven, or even 39 years. The time value of money made capital investment far less attractive from a tax perspective, even when it was economically superior. Chief financial officers naturally tilted toward hiring rather than investing. Even if this made sense in a period of high unemployment and inadequate demand for labor, it long ago became dysfunctional as we approached full employment.

And it not only retarded investment and productivity, but it also incentivized corporate America to lobby for more workers through loose immigration policies and lax border enforcement. Our politics and our economy became warped by the gravity of the tax code’s preference for workers over capital investment.

Full expensing removes that distortion. It levels the playing field between capital and labor expenditures, letting companies make decisions based on productivity and returns rather than quirks of the tax code. More importantly, it works hand-in-hand with immigration restrictions to encourage the kind of productivity-enhancing investment the economy needs. With unemployment at 4.4 percent and break-even employment growth under 40,000 per month, the constraint on our economy isn’t job creation. It’s making workers more productive. Full expensing incentivizes exactly that: investment in equipment, technology, and automation that increases output per worker. In a tight labor market with limited workforce growth, capital deepening is how you grow without inflation. The tax code should encourage it, not penalize it.

There Was Gold in Them Hills

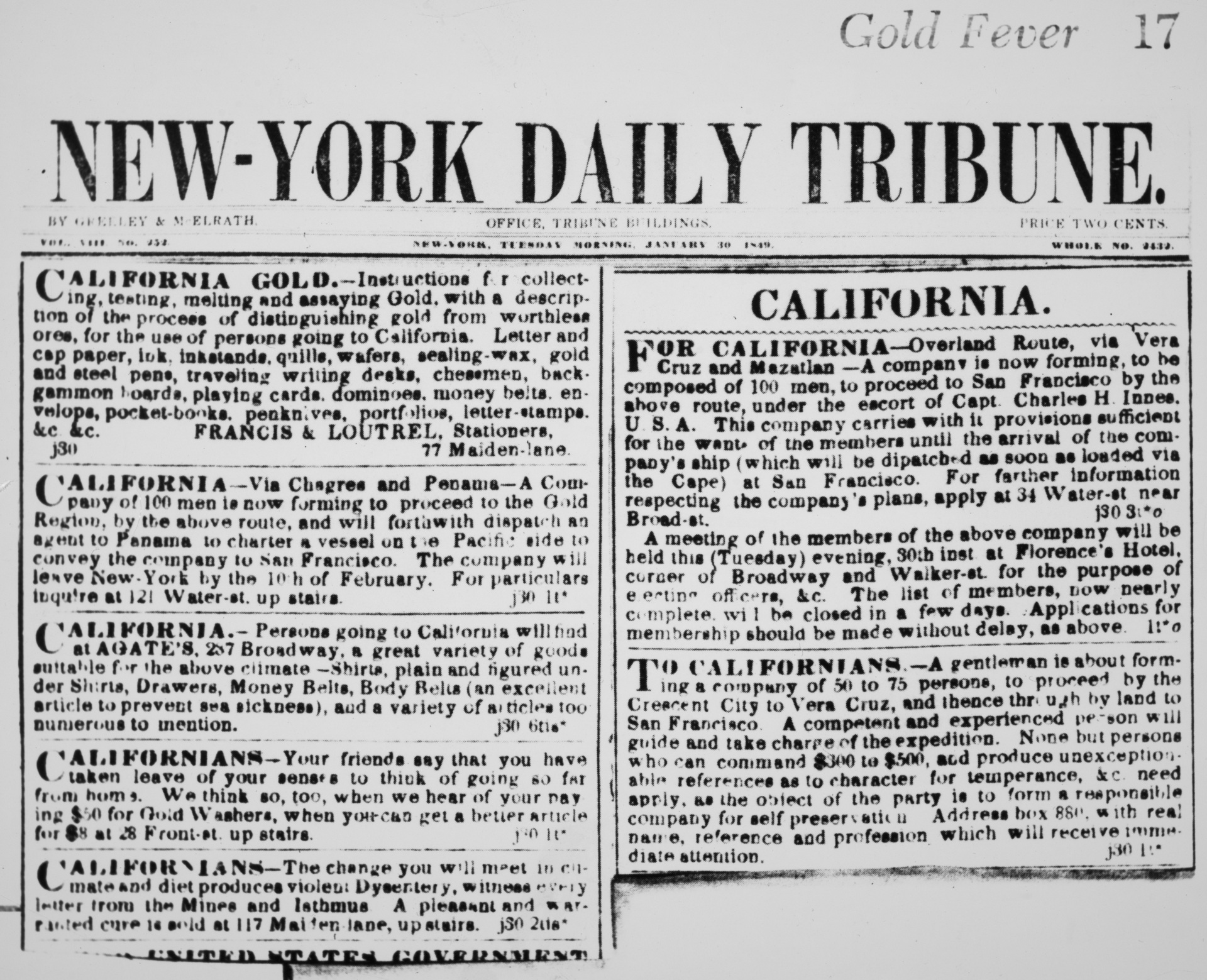

On January 24, 1848, a carpenter named James W. Marshall spotted flakes of gold in the tailrace of John Sutter’s sawmill on the American River, near what is now Coloma, California, an accidental discovery that detonated the modern history of the West. Word spread despite efforts to keep it quiet, and within months the trickle became a flood: prospectors poured in from across the United States and around the world, San Francisco exploded from a sleepy outpost into a boomtown, and the U.S. economy absorbed a sudden jolt of new money, new migration, and raw ambition. California was reforged, almost overnight, by the oldest human force of all: the belief that fortunes can be found in the dirt.

A page from the New-York Daily Tribune newspaper on January 30, 1849, containing advertisements related to the California Gold Rush. (American Stock Archive/Frederic Lewis/Archive Photos/Getty Images)