Washington’s gamble on metallic fast reactors could turn bomb metal into centuries of power.

In October 2025, the US Department of Energy launched an unprecedented offer: 19.7 tons of surplus weapons-grade plutonium, material that once sat at the heart of thousands of nuclear warheads, was now up for grabs by private reactor developers.

Of this total, 4.4 tons remain in pure metallic form and 15.3 tons as oxide powder. The fraction in metallic form is the prize. It is the only form that can be directly alloyed with uranium and zirconium to make the high-performance fuel pins favored by the new generation of sodium-cooled fast reactors (SFRs).

Contenders like Oklo (partnered with Lightbridge and Newcleo for Oak Ridge facilities), Curio (NuCycle demos), and TerraPower all have their eye on the prize, with selections due by year’s end. Applicants must foot all costs, potentially paying DOE fees, amid safeguards tying sites to IAEA lists.

The allure is not merely technical convenience but is also its breeding performance. A breeding ratio of 1.5 means that for every 100 kg of plutonium fissioned, the reactor produces 150 kg of new plutonium from the depleted-uranium blanket.

- Oxide fuel (MOX): breeding ratio ~1.1

- Mixed carbide fuel (as in India’s FBTR): breeding ratio 1.2-1.3

- Metallic U-Pu-Zirconium fuel: breeding ratio 1.3-1.5

The breeding performance of metallic fuel has been demonstrated in small batches during the EBR-II program and is now the clear objective of US companies such as Oklo, TerraPower, and ARC Technologies.

With the United States sitting on more than 700,000 tons of depleted uranium tails, a fleet of metallic-fueled SFRs seeded with the 4.4 tons of surplus metal could, in principle, generate terawatts of carbon-free electricity for centuries while continuously manufacturing its own fuel.

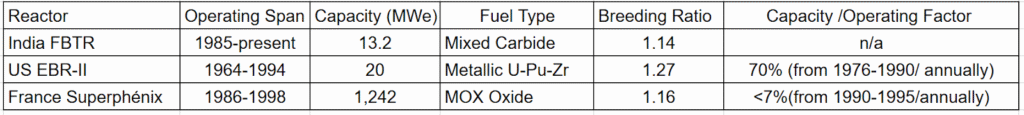

Historical Data for Plutonium Reactors

Sources: IAEA, ANL, IGC, and the World Nuclear Organization.

The 2025 American Bet on Plutonium

The DOE’s October 2025 Request for Applications explicitly prioritizes proposals that can use the 4.4 tons of metallic plutonium directly. Oklo, TerraPower, and their partners are designing reactors around the same U-Pu 10 percent zirconium alloy that powered EBR-II, aiming for the 1.3-1.5 breeding ratio that would make the initial 4.4-ton charge the seed for an exponentially expanding fleet. Once the first reactors reach equilibrium, no additional weapons-derived plutonium would ever be required. The system, theoretically, would breed its own fuel indefinitely from depleted uranium.

The Price of Non-Proliferation

Arms-control experts are deeply concerned about the implications of a breeding ratio of 1.3–1.5 in a closed metallic fuel cycle, as it necessitates industrial-scale pyroprocessing or electrorefining. These are technologies that separate essentially pure plutonium streams. The National Academies of Sciences has warned that deploying such facilities at a commercial scale introduces unique nonproliferation considerations and security risks. This challenges decades of US policy aimed at preventing the routine separation of weapons-usable material from falling into civilian hands.

Transporting 4.4 tons of weapons-grade plutonium from government sites to private fuel-cycle facilities, and operating multiple pyroprocessing plants under commercial control would impose unprecedented safeguards challenges on the International Atomic Energy Agency (IAEA). Even a small diversion or theft of a kilogram of this fuel would be a sufficient quantity to produce a crude nuclear device.

Plutonium, Power, and Geopolitics in the New Nuclear Era

The DOE’s plutonium initiative not only underscores America’s technological leadership aspirations but also marks a strategic pivot in the nation’s energy security doctrine. As global tensions from renewed great power competition to resource nationalism escalate, the promise of domestic, carbon-free, high-density power is irresistible for both civilian and military planners. Fast reactors fueled by surplus plutonium and depleted uranium offer a pathway to energy independence that sharply reduces a nation’s reliance on volatile foreign uranium supplies, especially from geopolitically sensitive regions.

Moreover, by converting Cold War armaments into fuel, the United States will set an economic and symbolic precedent. This aligns with national interest priorities that treat energy as a critical pillar in geopolitical strategy, as well as with calls for bolstering electrical grid reliability against climate-driven disruptions and supply chain vulnerabilities.

Yet, this ambition comes at a geopolitical cost. Normalizing civilian access to weapons-grade fissile materials, albeit under stringent safeguards, risks eroding international nonproliferation norms and could spur arms race dynamics elsewhere.

For policymakers, balancing these competing imperatives with innovative energy security and robust nonproliferation regimes will define the future trajectory of the global nuclear order. The 2025 plutonium program is at once a masterstroke of American scientific prowess and a test of its diplomatic finesse on the world stage.

About the Author: Stella Kim

Stella (SuHee) Kim is an investment and nuclear strategy expert with over a decade of experience bridging global finance and deep-tech, with a particular focus on small modular reactors (SMRs). She is the CEO of Pandia Bridge, a Singapore-based advisory firm that connects global investors and leading Korean conglomerates with top SMR developers, including NuScale Power, to facilitate cross-border investments and strategic partnerships. Her work centers on the intersection of energy security, technology innovation, and strategic finance on a global scale. She holds a BA from Ajou University in South Korea and participated in a study abroad program at the Luleå University of Technology in Sweden.

Image: Shutterstock/tunasalmon