Nuclear Energy Now tracks the latest nuclear energy developments across technology, diplomacy, industry trends, and geopolitics.

China Advances Thorium Molten Salt Reactor Technology

China has reached an important milestone in advanced reactor development with the world’s first successful conversion of thorium–uranium fuel in an operating molten salt reactor. The two-megawatt thermal (MWt) thorium molten salt reactor (TMSR)-LF1 prototype in Gansu Province was initially slated to be completed in 2024 after construction began in 2018. However, it was completed ahead of schedule in 2021 and achieved first criticality in 2023. Now, it has demonstrated continuous generation using liquid fuel and on-the-fly refueling, avoiding shutdown cycles required for conventional water-cooled reactors. Because the reactor does not require water for cooling, it could be deployed in arid regions where traditional reactors cannot be sited—an important aspect as China has expanded its nuclear energy export strategy. Chinese scientists describe the achievement as initial proof of the technical feasibility of a thorium fuel cycle—a notable step given that thorium is more abundant than uranium—and has potential for higher fuel utilization and produces less radioactive waste than conventional uranium fuel cycles. This development puts Beijing at the forefront of thorium research as global interest in fourth-generation reactors increases, marking a strategic step forward in China’s pursuit of next-generation nuclear technologies.

Momentum Grows for Nuclear Plant Life Extensions

Countries are turning to nuclear life extensions to preserve renewable, zero-carbon power. Spanish utility companies, Iberdola, Endesa, and Naturgy, have requested a three-year life extension for the two-unit Almaraz nuclear energy power plant—the country’s largest—after a widespread blackout in April revived debates regarding baseload capacity and cast doubt on Madrid’s plan to close all reactors by 2035. Meanwhile, South Africa has approved a 20-year extension for Koeberg-2 following extensive maintenance and upgrades. This decision will keep the continent’s only nuclear power plant running until 2045—an important signal for a region where countries such as Egypt, Ghana, Kenya, and others are pursuing first-time nuclear programs. And, in South Korea, a 10-year extension was granted to its oldest active reactor, Kori-2, setting a precedent for nine other aging units that Korea Hydro and Nuclear Power (KHNP) may seek extensions for.

Italian SMR Developer Looks to The United States

Italian advanced-reactor startup Newcleo is weighing a pivot in its deployment strategy as it considers shifting its planned fleet of 20 small modular reactors (SMRs)—worth an estimated $19 billion—from the United Kingdom (UK) to the United States. President Donald Trump’s executive orders on nuclear energy and broader deregulatory agenda have made the United States a more attractive investment destination when compared to Europe, especially as approvals can take two to three times longer in Europe. Newcleo has also pledged to invest up to $2 billion to develop uranium fuel facilities in the United States, alongside American SMR company Oklo. If the shift proceeds, each reactor would represent a sizable vote of confidence in the US SMR market and reflect a broader trend of advanced reactor developers gravitating toward markets with clearer regulatory timelines and pro-nuclear industrial policy.

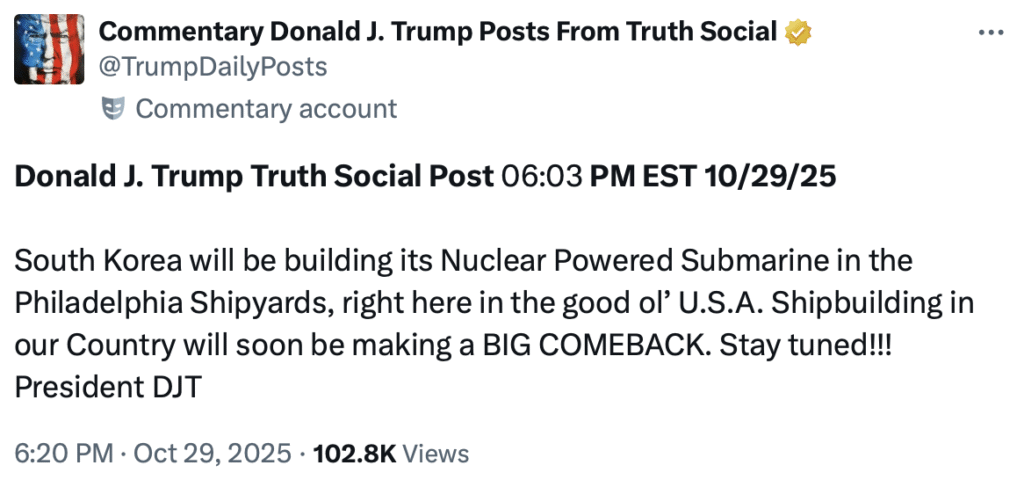

South Korea Gets Approval for Nuclear-Powered Submarines

The United States has granted South Korea approval to build nuclear-powered submarines, following Trump’s visit to Asia for the Asia-Pacific Economic Cooperation (APEC) summit. South Korean President Lee Jae-myung emphasizedthat Seoul seeks nuclear energy propulsion—not nuclear-armed vessels—to improve its ability to track North Korean and Chinese submarines, a capability that diesel boats are unable to match. The agreement is embedded in a broader trade deal, which includes $150 billion in Korean investment in US shipbuilding and an additional $200 billion in US industrial sectors, and follows Seoul’s repeated requests for permission to reprocess nuclear fuel for submarines. President Trump announced the deal via Truth Social, noting that “South Korea will be building its Nuclear-Powered Submarine in the Philadelphia Shipyards.” While the move deepens US–ROK defense industrial cooperation, China has raised nonproliferation concerns, with Chinese ambassador to South Korea, Dai Bing, saying the partnership “goes beyond a purely commercial partnership, directly touching on the global nonproliferation regime and the stability of the Korean Peninsula and the wider region.” The decision also comes as the United States advances other nuclear-submarine partnerships. In October, Trump gave the go-ahead for the AUKUS nuclear-powered submarine deal at a White House meeting with Australian Prime Minister Anthony Albanese, following a Pentagon review that had put the alliance into question.

About the Author: Emily Day

Emily Day is an experienced researcher, writer, and editor with expertise in geopolitics, nuclear energy, and global security. She is an Associate Editor of Energy World and Techland at The National Interest and a Senior Research Associate at Longview Global Advisors, where she provides insights on global political and economic trends with a specialization in utilities, risk, sustainability, and technology. She was previously a Della Ratta Energy and Global Security Fellow at the Partnership for Global Security.

Image: Aleksandr Merkushev/shutterstock