The 2010 Affordable Care Act established the biggest federally funded entitlement for Americans in the labor force. To ensure that this spending was focused on those unable to provide for themselves, the law initially concentrated assistance on those reporting the lowest incomes. But as the government expanded these and other benefits during Covid, it has increased the incentive for workers to claim additional funds by hiding income. The federal government is currently shut down, with both parties arguing over whether to make those expanded benefits permanent.

Electronic finance dominates the modern economy. Americans get paid every month by direct deposit, purchase goods and services with credit cards, and increasingly use mobile apps to transfer money. But cash remains king in some sectors. From lawn care to house cleaning and servicing of domestic appliances, many small businesses insist on being paid the old-fashioned way.

Finally, a reason to check your email.

Sign up for our free newsletter today.

This is not just a matter of aversion to credit-card fees or even the traditional desire by high earners to dodge taxes. It reflects the growing availability of federally financed benefits reserved for workers with low reported incomes.

Estimates suggest that one out of six construction workers in California get paid off the books. Long before the push for “no taxes on tips,” the IRS estimated that over 60 percent of gratuities received in restaurants went undeclared—a practice facilitated by the much lower formal minimum wage for tipped workers.

A recent study of audit data from the Internal Revenue Service found that the proportion of the bottom 20 percent of earners misreporting their taxable-income situation grew from 26 percent to 37 percent from 2006 to 2015. The three middle-income quintiles, meantime, held steady at 19 percent.

Federal authorities struggle to monitor income from sole proprietorships, which accounts for four-tenths of all underreported income. Self-employment also provides an array of opportunities for individuals to manipulate their personal income levels by storing funds on business balance sheets. This is legal.

Until recently, most U.S. entitlement spending went to retired and disabled Americans not engaged in “substantial gainful activity.” In 2007, spending on Social Security, Supplemental Security Income, Medicare, and Medicaid benefits for the aged and disabled amounted to $1.7 trillion (in 2022 dollars), while only $308 billion was spent on cash and health-care entitlements for households in the labor force. In 2010, the Affordable Care Act became law. By 2022, real spending on benefits for able-bodied working-age households had surged to $1.1 trillion—76 percent of it on health care.

The ACA expanded Medicaid to able-bodied working-age households, providing free comprehensive health-care benefits to those declaring incomes of less than 138 percent of the federal poverty level. One study found that the extension of benefits led to the “bunching” of reported taxable income below this eligibility cut-off, concentrated among the self-employed, without any associated change in labor supply.

Nonetheless, several factors initially mitigated the susceptibility of the ACA’s Medicaid expansion to income underreporting. First, the income cut-off for Medicaid is too low for most successful self-employed workers to claim eligibility plausibly. Second, the ACA provided subsidies covering much of the cost of health insurance purchased from the exchange to households with incomes above the Medicaid eligibility cut-off (diminishing gradually between 138 percent and 400 percent of the federal poverty level).

ACA exchange subsidies themselves induced substantial underreporting. A 2021 study found bunching of reported incomes below 400 percent of the poverty level, concentrated among those who purchased plans. It found a greater effect among the self-employed and evidence that many workers made Individual Retirement Account contributions to reduce their taxable income in order to qualify.

During Covid, Congress eliminated the cap on eligibility for the ACA’s income-related subsidies and greatly expanded them. As a result, a family of four headed by a 50-year-old would be entitled to $2,535 per year in assistance with premiums if reporting an income of $250,000. If the household reported only $150,000, the subsidy would expand to $11,035. Tough the self-employed accounted for only 7 percent of those made eligible by the pandemic-era expansion of ACA subsidies, they disproportionately lacked group insurance coverage and made up 38 percent of those in that cohort who enrolled.

States lack strong incentives to enforce eligibility limits for beneficiaries of the Medicaid expansion, as doing so would cost them $9 in federal matching funds for every $1 they save. Individuals typically claim subsidies to purchase ACA plans based on estimates of their annual income, and the IRS generally lacks the resources to reclaim overpayments; in many cases it is prohibited from doing so.

This Covid-era expansion of subsidies also made ACA insurance-exchange plans free for those declaring incomes between 100 percent and 150 percent of the federal poverty level. A study by the Paragon Health Institute found that 8.7 million people enrolling in exchange plans claimed to have income at this level, though only 5.1 million were “likely eligible for such coverage.”

If they allow workers to claim cash benefits by hiding earnings from authorities, other benefits for working households may do even more than health-insurance subsidies to encourage the misreporting of income. The Earned Income Tax Credit (EITC) currently faces an improper-payment rate of 33 percent—more than three times that for assistance to the elderly and disabled poor through SSI. The EITC is currently fairly modest and in most cases merely offsets payroll taxes owed by households. But if it were expanded into a substantial handout to any working household reporting low incomes, it could establish a direct reward for off-the-books employment.

Because it still largely limits its publicly funded benefits to those unable to work, the United States has a relatively small shadow economy. An International Monetary Fund study estimated that from 1991 to 2015, only 8 percent of U.S. economic activity was off-the-books, compared with 13 percent in Sweden, 14 percent in Canada, and 25 percent in Italy. But the U.S. shadow economy would likely grow if benefits for those reporting low incomes were substantially expanded—especially as it would require higher taxes on earnings, which are fully declared.

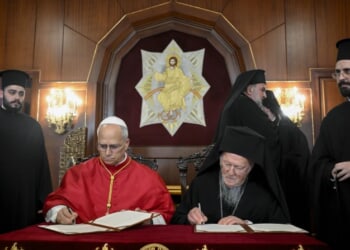

Photo by FREDERIC J. BROWN/AFP via Getty Images

City Journal is a publication of the Manhattan Institute for Policy Research (MI), a leading free-market think tank. Are you interested in supporting the magazine? As a 501(c)(3) nonprofit, donations in support of MI and City Journal are fully tax-deductible as provided by law (EIN #13-2912529).

Source link